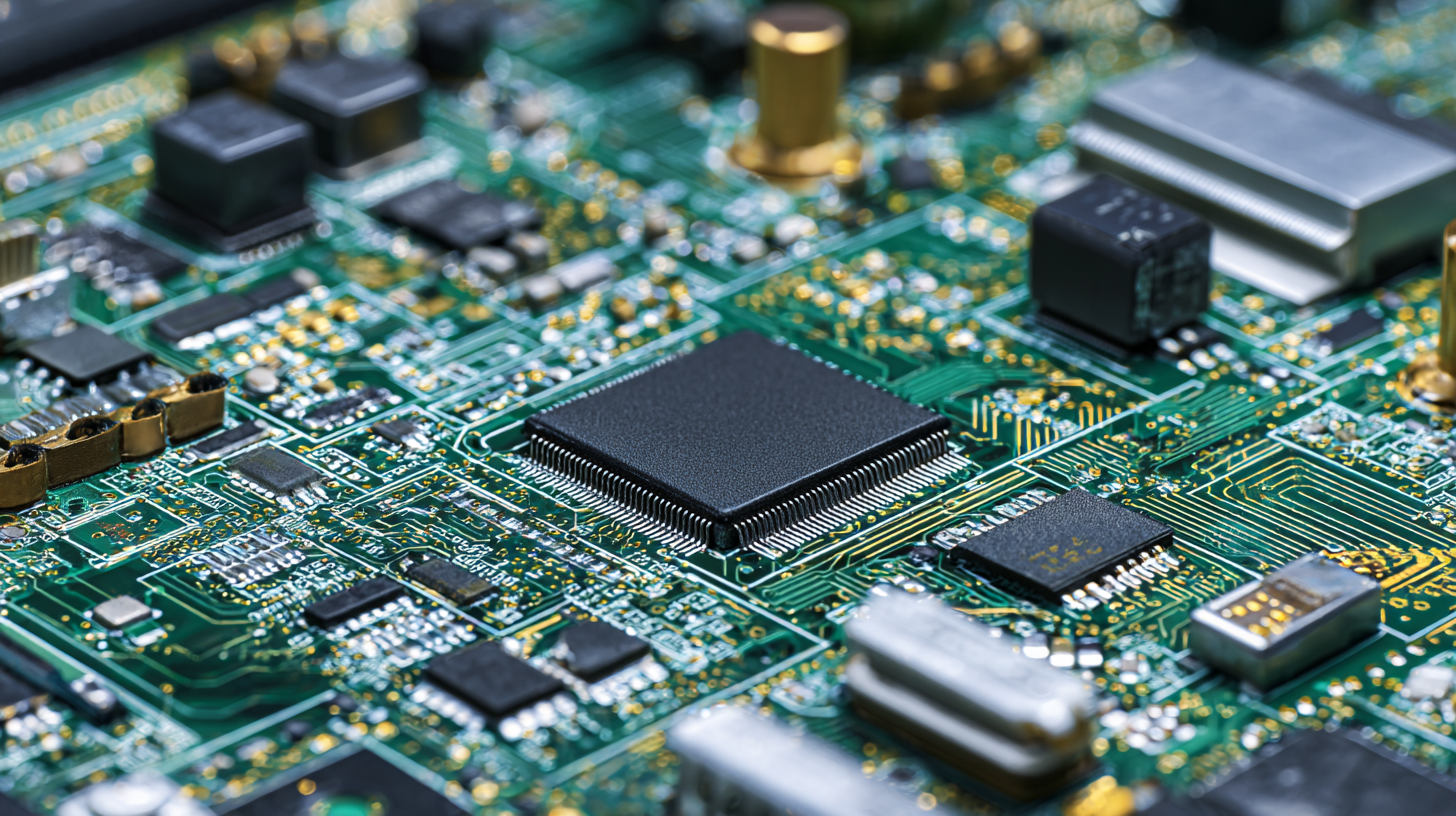

Leading the Way: Unmatched Export Strength of China’s Top PCB Circuit Boards

In recent years, the global market for PCB circuit boards has witnessed significant growth, with China emerging as a dominant player. According to industry reports, the value of China's PCB export market is projected to reach approximately $35 billion by 2025, driven by the increasing demand for advanced electronic devices across various sectors, including automotive, consumer electronics, and telecommunications. As technology continues to evolve, innovations such as 5G networks and Internet of Things (IoT) applications demand higher-quality and more complex PCB circuit boards, placing China at the forefront of manufacturing excellence. This blog explores the unmatched export strength of China's top PCB circuit boards, highlighting trends and capabilities that are leading the way in the industry.

Key Factors Driving China's PCB Export Growth by 2025

China's leadership in the global PCB market is underscored by its unmatched export strength, significantly driven by advancements in technology and manufacturing capabilities. The PCB market is set to witness remarkable growth, with projections indicating that the global ICT testing probe market will reach approximately $379.6 million by 2025, expanding to $614.36 million by 2033 at a compound annual growth rate (CAGR) of 6.2%. This surge in demand for sophisticated testing solutions is pivotal for ensuring the quality and reliability of PCBs, thereby fueling China's export growth.

Several key factors contribute to this robust export performance. Firstly, China’s focus on innovation in materials and processes has led to the production of high-quality, cost-competitive PCBs. Additionally, the integration of advanced technologies such as automation and AI in manufacturing has enhanced operational efficiency, allowing for faster turnaround times and better product customization. As a result, China not only dominates the global PCB supply chain but also positions itself strategically to meet the rising needs of various industries, further solidifying its export status as we approach 2025.

Market Trends: Future Projections for PCB Demand in Global Industries

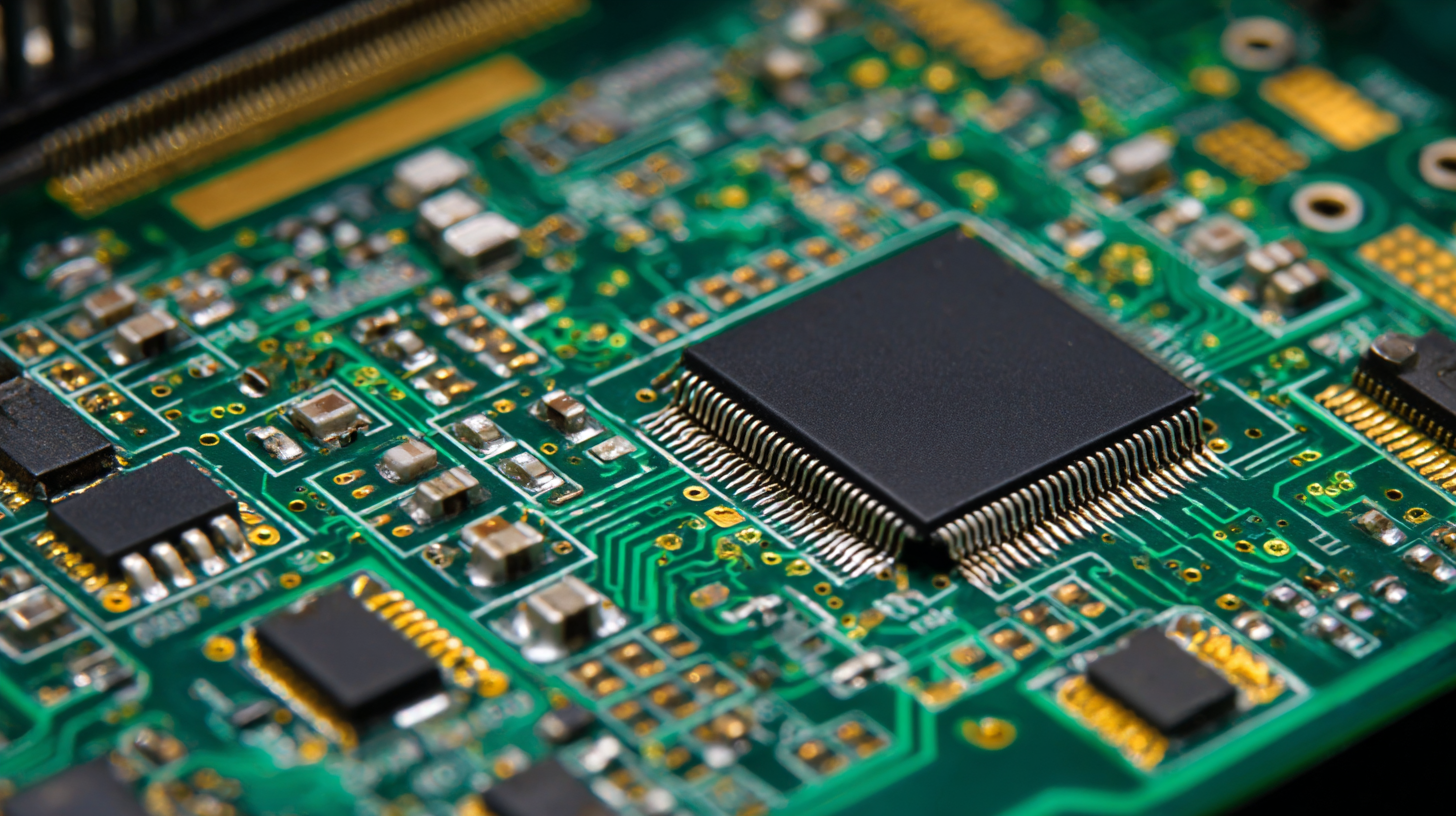

The global printed circuit board (PCB) market is experiencing significant growth, projected to expand from a valuation of $696.9 billion in 2023 to $1.1349 trillion by 2032. This growth is indicative of the increasing demand for high-tech electronics across various industries, particularly in telecommunications, automotive, and consumer electronics. As the centerpiece of electronic devices, PCBs are essential for functionality and innovation, fostering the development of advanced products that require more complex circuit designs.

Additionally, the specialized materials used in PCB manufacturing, such as copper-clad laminates, are crucial for the industry’s evolution. A recent report highlights a promising outlook for the copper-clad laminate sector, discussing market trends from 2025 to 2031. This segment is not only vital for the production of PCBs but also reflects broader technological advancements. With companies focusing on high-end technology breakthroughs and supply chain collaborations within China, the future of the PCB industry seems robust and bright, ensuring its leadership in the global market.

Leading the Way: Unmatched Export Strength of China’s Top PCB Circuit Boards - Market Trends: Future Projections for PCB Demand in Global Industries

| Industry Sector | Current PCB Demand (Million Units) | Projected Growth Rate (%) | Projected Demand (Million Units, 2025) |

|---|---|---|---|

| Consumer Electronics | 250 | 8.5 | 272 |

| Automotive | 180 | 7.0 | 192.6 |

| Telecommunications | 150 | 9.5 | 164.25 |

| Medical Devices | 120 | 6.0 | 127.2 |

| Industrial Electronics | 100 | 5.5 | 105.5 |

Technological Advancements Shaping the PCB Manufacturing Landscape

The landscape of PCB (Printed Circuit Board) manufacturing is undergoing a transformative shift driven by accelerated technological advancements. According to a report by MarketsandMarkets, the PCB market is projected to reach USD 82.33 billion by 2026, growing at a CAGR of 4.78% from 2021 to 2026. This growth is largely fueled by innovations in materials and manufacturing processes that not only enhance production efficiency but also improve the performance and reliability of PCBs. Advanced technologies such as HDI (High-Density Interconnect) and flexible PCBs are becoming increasingly prevalent, allowing manufacturers to meet the rising demands of complex electronic devices.

China, as a global leader in PCB production, is at the forefront of these technological advancements. The country accounted for over 40% of the global PCB market share in 2022, as reported by Statista. Investments in automation and smart manufacturing are further bolstering China's competitive edge. Notably, the adoption of IoT (Internet of Things) in manufacturing processes is enabling real-time monitoring and predictive maintenance, significantly reducing downtime and operational costs. This strategic adoption of advanced technology positions China not only as a key player in the PCB industry but also as a trailblazer for future developments in electronic manufacturing.

Competitive Analysis: China's Position in the Global PCB Market

China's dominance in the global printed circuit board (PCB) market is a testament to its unmatched export capabilities and robust manufacturing infrastructure. As the global PCB market was valued at approximately $69.69 billion in 2023, it is projected to experience significant growth, reaching $113.49 billion by 2030. This rapid expansion underscores China's strategic position, particularly as demand surges for PCBs driven by advancements in consumer electronics, automotive applications, and aerospace technologies.

Moreover, specific segments within the PCB market are witnessing exciting developments. The Aerospace Printed Circuit Board Market alone is forecasted to grow from $1.2 billion in 2024 to an impressive $1.9 billion by 2034. This growth is propelled not only by increasing technological requirements in aviation but also by the heightened focus on reducing weight and improving efficiency through innovations like rigid-flex PCBs. As China continues to evolve its capabilities, particularly in high-volume manufacturing, its influence in the global PCB landscape is anticipated to strengthen further, reinforcing its leadership position in the industry.

Strategies for Success: How Businesses Can Leverage China's PCB Strengths

China's prowess in the PCB sector is a cornerstone for businesses looking to enhance their competitiveness in the global market. By capitalizing on China's unmatched export capabilities, companies can streamline their supply chains and reduce production costs. The use of advanced manufacturing technologies and an expansive infrastructure allows Chinese PCB manufacturers to offer high-quality products at competitive prices. Businesses can leverage these advantages by forming strategic partnerships with manufacturers, ensuring a reliable supply of essential components that meet their specifications while maintaining tight control over production timelines.

Furthermore, to fully tap into China's PCB strengths, companies should prioritize knowledge sharing and technical collaboration. Engaging with local suppliers can provide invaluable insights into market trends and emerging technologies. Companies can also participate in trade fairs and industry conferences held in China to network with leading PCB manufacturers and explore innovative solutions. By embracing these strategies, businesses not only enhance their operational efficiency but also position themselves to respond swiftly to changing market demands, thus reinforcing their foothold in the electronic components industry.